Research

Kevin is the head of market structure & technology research for Coalition Greenwich. Below is a sample of his recently published work.

Understanding Fixed-Income Markets in 2023 | Coalition Greenwich

Executive Summary Fixed-income markets are the lifeblood of the global economy. Access to credit—in other words, the ability to borrow money—played a

Wealth Management Firms Set Technology Priorities for 2023 | Coalition Greenwich

The technology investments wealth management firms make today will play a big role in determining their ability to support financial advisors in their

Understanding the Structure and Opportunity of Retail Bond Trading | Coalition Greenwich

According to the Federal Reserve, U.S. households held nearly $108 trillion in investable assets at the end of September 2022. Nine percent of the

The Digitization of Corporate Bond Issuance | Coalition Greenwich

Corporate bond new issuance is trending downward, following an absolutely blockbuster year in 2021 and a stronger than anticipated Q1 2022. While this

Automation is Coming to the Municipal Bond Market | Coalition Greenwich

Municipal bond markets are ripe for increased automation. The buy side wants better access to liquidity and more transparency, and the dealer

The Role of ESG in Bond Trading | Coalition Greenwich

More than half a trillion dollars of green bonds were issued in 20211, the highest level since the market was defined. This category encompasses both

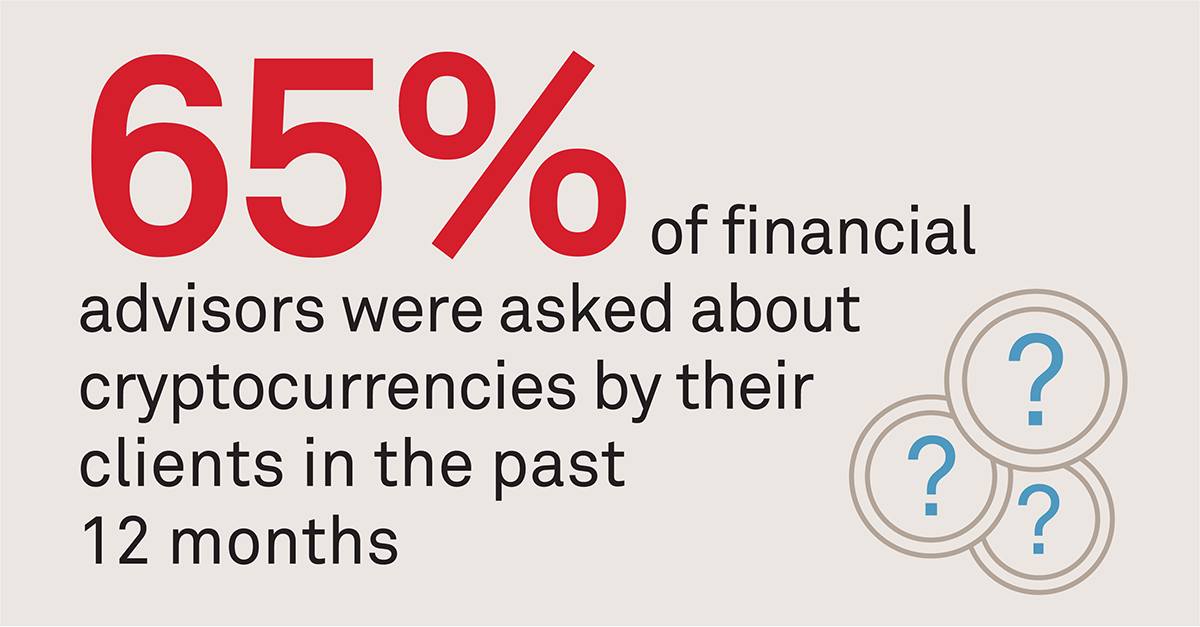

Retail Investors Want Crypto, but Advisors Face Roadblocks | Coalition Greenwich

Retail investors are talking to their financial advisors about cryptocurrencies. In fact, recent Coalition Greenwich research found that two-thirds of

Equity Trading Systems Continue to Converge, Move to the Cloud | Coalition Greenwich

An Evolving but Mature Market Eighty-six percent of buy-side equity investors in the U.S. use a third-party order management system (OMS). Of those,

Transparency is Coming for Portfolio Trading | Coalition Greenwich

The days of corporate bond portfolio trading estimates are coming to an end. FINRA has proposed and the SEC has approved a new rule (proposed FINRA

Financial Advisors Questioned by Retail Investors on Inflation, Crypto, but not PFOF | Coalition Greenwich

Investment in “wealthtech,” or digital solutions that facilitate wealth management processes, hit record levels in 2021. Demand has been driven by a

Electronification and Market Access Drive Alpha in Asian Bond Markets | Coalition Greenwich

Executive Summary Portfolio managers aren’t the only ones generating alpha. While trading was once only a necessary cost for implementing an

January Spotlight: U.S. Corporate Bond Market Structure: 2021 by the Numbers | Coalition Greenwich

Trading in corporate bond markets was surprisingly steady in 2021, despite macroeconomic factors that would have suggested a much more volatile year.

Unique Markets Present Unique Opportunity for Wealth Managers | Coalition Greenwich

Executive Summary While retail investors have taken to do-it-yourself tools in unprecedented numbers over the past two years, their use of financial

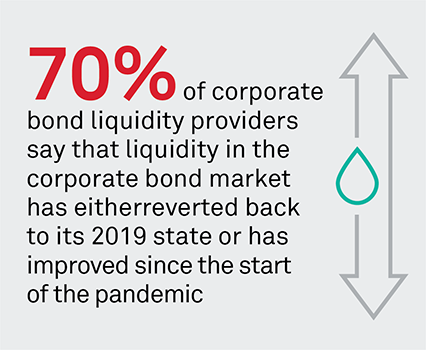

Investing in Corporate Bond Liquidity: The Dealer View | Coalition Greenwich

Liquidity in both the investment-grade and high-yield corporate bond markets has either reverted back to its 2019 state or has improved since the